Incentives & Financing

Skagit County offers a range of financing options to support business growth, from low-interest SBA 504 loans and community development funds to local revolving loan programs and industrial revenue bonds. These resources are designed to help businesses expand and thrive in Skagit’s vibrant economy. Explore the information below to find the funding solution that’s right for your business.

Incentives

Skagit County Incentives

Streamlined Permitting

Skagit County can offer streamlined permitting for facilities located in unincorporated county areas, depending on the nature of the project. For more information, contact EDASC or Skagit County Planning and Development Services.

Infrastructure Improvement

Skagit County has access to economic development grants of up to $500,000 per project that can be used to support road, infrastructure, and site/building improvements, among other types of projects that support a public economic development benefit. This couples with state-level grant and funding opportunities for infrastructure through the Community Economic Revitalization Board (CERB) and similar initiatives. For more information, contact EDASC.

Opportunity Zones

Skagit County features federally designated Opportunity Zones in Mount Vernon, Anacortes, and Sedro-Woolley. Visit our Opportunity Zones page to learn more about this investment incentive and related opportunities.

Value-Added Agriculture Innovation Partnership Zone (IPZ)

For value-added agriculture products, the IPZ, which is centered around the Port of Skagit’s airport and business park facilities, has emerged as a center for innovative value-added agriculture research and production within Washington State. Close proximity to these facilities will support agriculture processing and other value-added agriculture businesses in partnering with and utilizing these assets to scale up their activities. Learn More

Veterans

Employers hiring veterans may be eligible for special tax credits and incentives. More information is available through the U.S. Department of Veterans Affairs Veterans Opportunity to Work web portal.

Washington State Tax Exemptions and Incentives

Washington state offers a diverse range of competitive tax incentives for businesses, many of which are tailored to specific industry sectors. Examples include:

Aerospace Firms Incentives

- Credit against the B&O Tax for preproduction development expenditures.

- Credit against the B&O Tax for property/leasehold taxes paid on aerospace manufacturing facilities.

- Sales & Use Tax exemption for computer hardware/software and peripherals.

- All manufacturing equipment is exempt from Sales Tax

Renewable Energy/Green Incentives

- Property and leasehold excise tax exemption for owners and operators of anaerobic digesters

- Sales & Use Tax deferral program for clean energy investment projects

- Manufacturers of solar energy systems/components can take advantage of a reduced B&O Tax rate. Additionally, installed equipment for the generation of alternative energy is exempt from the Sales Tax.

Agriculture & Food Processing Incentives

- B&O Tax exemption/deduction for manufacturers of fresh fruits and vegetables

- B&O Tax exemption/deduction for manufacturers of seafood

- B&O Tax exemption/deduction for manufacturers of dairy products.

Workforce Training

The Job Skills Program is a competitive grant that offers customized training through the community college system with 50% cost share by the state. The Customized Employment Training Program provides participating businesses a B&O tax credit for 50% of their payment to the training program.

Businesses in Skagit County enjoy the following state tax exemptions, in addition to sector and project-specific incentives:

B&O Credit for New Employees in Manufacturing and Research & Development in Rural Counties

- Available to: Manufacturers, R&D laboratories, and commercial testing facilities located in rural counties or within a Community Empowerment Zone (CEZ).

- Qualifying Activity: Creating new employment positions/increase in-state employment by 15%.

- Credit Amount: $2,000 credit/position with annual wages/benefits of $40,000 or less; or

- $4,000 credit/position with wages/benefits of more than $40,000 annually.

Machinery and Equipment Sales & Use Tax Exemption

- Available To: Manufacturers and processors for hire performing manufacturing and R&D. Testing operation for a manufacturer and processor for hire.

- Qualifying Activity: Purchase of qualifying machinery and equipment used directly in a manufacturing operation or research and development performed by a manufacturer, or testing operations performed for a manufacturer.

- Savings Rate: 8.5%

Opportunity Zones

Opportunity Zones are an economic development tool designed to spur economic development and job creation in distressed communities by providing tax benefits to investors. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation authority to the Internal Revenue Service.

In an Opportunity Zone, investors can defer tax on any prior gains until the earlier of the date on which an investment is sold or exchanged, or December 31, 2026, so long as the gain is reinvested in a Qualified Opportunity Fund. Second, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor would be eligible for an increase in basis equal to the fair market value of the investment on the date that the investment is sold or exchanged.

Washington Governor Jay Inslee has designated five census tracts Skagit County cities as Opportunity Zones:

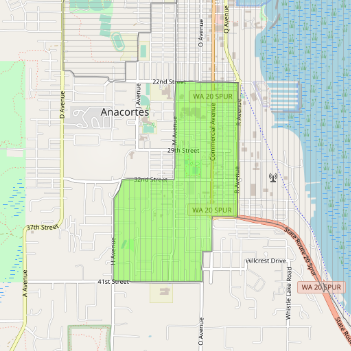

Anacortes: The Opportunity Zone in Anacortes, nominated by the Samish Indian Nation, incorporates much of southern Commercial Avenue and the neighborhoods north of Mt. Erie Elementary School. This area includes a mix of residential neighborhoods, Island Hospital, and commercial establishments, as well as the Samish Indian Nation’s tribal headquarters. The Samish Indian Nation, City of Anacortes, and EDASC hope that the Opportunity Zone designation will bring more affordable housing options for low-income residents, as well as new commercial opportunities. The selection of this tract will compliment Samish community and economic development efforts

Anacortes: The Opportunity Zone in Anacortes, nominated by the Samish Indian Nation, incorporates much of southern Commercial Avenue and the neighborhoods north of Mt. Erie Elementary School. This area includes a mix of residential neighborhoods, Island Hospital, and commercial establishments, as well as the Samish Indian Nation’s tribal headquarters. The Samish Indian Nation, City of Anacortes, and EDASC hope that the Opportunity Zone designation will bring more affordable housing options for low-income residents, as well as new commercial opportunities. The selection of this tract will compliment Samish community and economic development efforts

“The Samish Indian Nation is excited for the possible private-sector investment opportunities that this designation will open up within our community. With limited space and the restrictions of living on an island, this designation will help create incentives to help our region. We are thankful and excited to be a part of this opportunity and to support the community we live in.” -- Chairman Tom Wooten, Samish Indian Nation

“This is an incentive to help attract investment to Anacortes, and we appreciate the Samish Nation identifying this tract to be an opportunity zone.” -- Mayor Laurie Gere, City of Anacortes

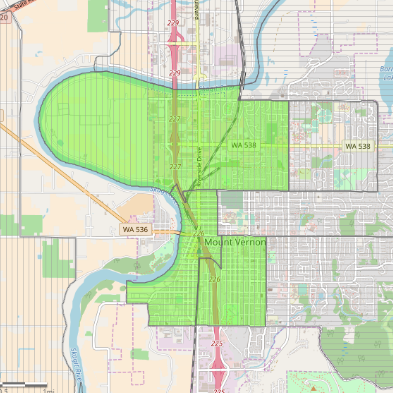

Mount Vernon: Downtown Mount Vernon and the western end of College Way make up three census tracts designated as Opportunity Zones. These incorporate most of Mount Vernon’s commercial area including the historic downtown, as well as part of Skagit Valley Hospital.

“These new zone designations, coupled with the relief provided by our floodwall project, have Mount Vernon poised for some very exciting growth opportunities. We are already seeing increased interest from investors.” -- Mayor Jill Boudreau, City of Mount Vernon

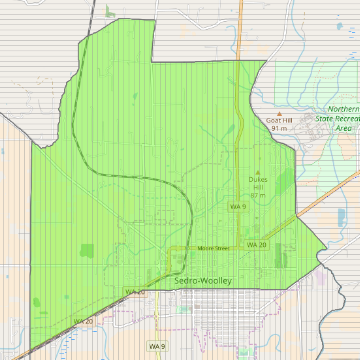

Sedro-Woolley: This zone includes much of the commercial and industrial areas of Sedro-Woolley, as well as areas that would benefit from further development of affordable housing.

Sedro-Woolley: This zone includes much of the commercial and industrial areas of Sedro-Woolley, as well as areas that would benefit from further development of affordable housing.

Sedro-Woolley Mayor Julia Johnson characterized the Opportunity Zone designation as “an incentive to provide our community the ability to pursue with flexibility the best possible mix of investments in business, infrastructure, housing, and more.”

EDASC welcomes inquiries from potential investors interested in learning more about Skagit County’s Opportunity Zones. The Washington State Department of Commerce will share technical guidelines and advice from the Internal Revenue Service as they become available.

Information Resources on Opportunity Zones

- Washington State Department of Commerce - Opportunity Zones Information

- U.S. Treasury Department - Opportunity Zone Frequently Asked Questions

- CDFA Opportunity Zones Resource Page

- NDC Opportunity Zones Presentation and Frequently Asked Questions

*Note: All maps above are screen captures taken from the Washington State Department of Commerce’s website

Financing

Industrial Revenue Bonds

The Washington Economic Development Finance Authority (WEDFA) can issue taxable non-recourse economic development bonds, a form of financing similar to tax-exempt industrial revenue bonds. WEDFA has the authority to issue non-recourse economic development bonds on both a taxable and tax-exempt basis in support of qualifying projects — manufacturing and processing facilities and projects categorized as "exempt facilities" under federal tax law. These may include wastewater, solid waste disposal, mass commuting, and some types of recycling and cogeneration projects. WEDFA cannot assist retail projects. For more information, click here.

SBA 504 Loan Program

The Northwest Business Development Association (NWBDA) provides long-term small business loans at low, fixed rates to help develop job creation and economical growth. As a licensed Certified Development Company (CDC) by the U.S. Small Business Administration (SBA), NWBDA is able to administer small business loans through the SBA 504 programs. Learn more and apply for a loan here.

Community Development Loan Fund

The Heritage Bank Community Development Enterprise finances businesses in economicallystressed areas, breathing new life into neglected and underserved low income communities. Heritage Bank formed its own Community Development Entity (CDE) to expand the financing we bring to businesses in low-income communities in Washington and Oregon. It is one of only a handful of CDEs in both states able to facilitate these loans.

Heritage Bank uses its own capital to make loans to businesses operating in these communities on better rates and terms with more flexibility than the market. In alignment with its commitment to the communities it serves, these loans aim to revitalize development by creating jobs and increasing the availability of goods and services in economically distressed areas. Click here to learn more.

Community Economic Revitalization Board (CERB) Program

This Washington state program provides low-cost financing for public facilities improvements required for private development. Low-interest loans and occasional grants are available to cities, counties, ports, and special utility districts to offset infrastructure costs and assist in the development and retention of jobs. Eligible projects include access roads and sewer and water extensions as well as other public improvements required to make sites attractive for private sector development. Infrastructure funded by CERB must serve either basic industries (manufacturing, processing, assembly, production, warehousing, and distribution) or external services (businesses that support the trading of goods and services outside state borders). More information is available at: www.commerce.wa.gov/cerb

Energy Efficiency Loans

The Washington State Housing Finance Commission offers Sustainable Energy Trust loans of up to $1 million for clean energy projects, as well as energy efficiency projects for multi-family housing and non-profit organizations, and on new construction of highly efficient single-family housing. More information is available through the WSFHC.

Clean Energy Fund

Washington state’s Clean Energy Fund supports the development, demonstration and deployment of clean energy technologies that save energy, reduce energy costs, reduce harmful air emissions and increase energy independence. Programs include financing opportunities for renewable energy manufacturing facilities, matching funds for renewable energy research and development, and grants supporting non-profit revolving loan fund programs. More information is available through the Washington State Department of Commerce.

New Farmer Loans

The Washington State Housing Finance Commission, in partnership with Northwest Farm Credit Services, provides low-interest loans to help new farmers get started with land, equipment, buildings, and even animals. More information is available through the WSFHC.

Grow America

Founded as a national nonprofit in 1969, Grow America, formerly NDC, has worked for over half a century fulfilling our mission to increase the flow of capital for investment in low-income communities. We direct capital to support the development and preservation of affordable housing, the creation of jobs through training and small business lending, and the advancement of livable communities through investment in social infrastructure. Learn more here.